GST revenue collection in Bihar falls by 5% to Rs 1,397 crore in Sept

India’s GST revenue collection rose by 10% to Rs 1.63 lakh crore in Sept

Revenue collection from Goods and Services Tax (GST) in Bihar dropped by 5% year-on-year to Rs 1,397 crore in September as compared to Rs 1,466 crore recorded in the same month last year, the government data showed.

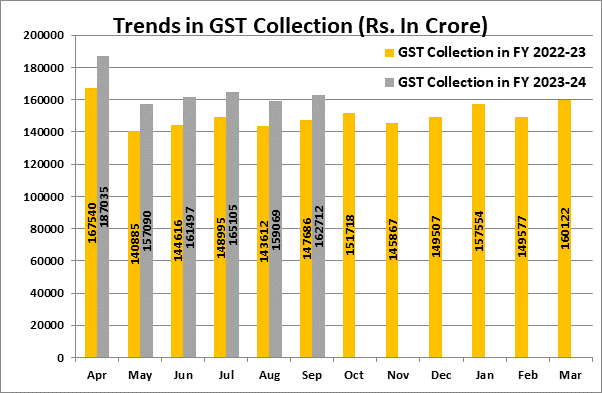

GST revenue collection in Bihar declined despite a robust growth registered on the national level. Overall GST revenue collection of the country rose by 10% year-on-year to Rs 1.63 lakh crore in September.

During the month of September, revenues from domestic transactions (including import of services) were 14% higher than the revenues from these sources during the same month last year. It is for the fourth time that the gross GST collection has crossed Rs 1.60 lakh crore mark in the financial year 2023-24.

The gross GST revenue collected in the month of September stood at Rs 1,62,712 crore, out of which Central Goods and Services Tax (CGST) is Rs 29,818 crore, State Goods and Services Tax (SGST) Rs 37,657 crore, Integrated Goods and Services Tax (IGST) Rs 83,623 crore and cess Rs 11,613 crore, as per data released by the Union Ministry of Finance on Sunday.

The total IGST during the month includes Rs 41,145 crore collected on import of goods, while cess also includes Rs 881 crore collected on import of goods.

September GST collection is also higher on a month-on-month basis. GST revenue collection in August stood at Rs 1.59 lakh crore.

On devolution of tax revenue to states, the Union Finance Ministry said, the central government has settled Rs 33,736 crore to CGST and Rs 27,578 crore to SGST from IGST. The total revenue of centre and the states in the month of September, 2023 after regular settlement is Rs 63,555 crore for CGST and Rs 65,235 crore for the SGST.

Cumulative GST collection for the first six months of the current financial year stood at Rs 9,92,508 crore as compared to Rs 8,93,334 crore recorded in the corresponding period of 2022-23, registering year-on-year growth of 11%.

The average monthly gross collection in the first half of 2023-24 stands at Rs 1.65 lakh crore, which is 11% higher than average monthly collection of Rs 1.49 lakh crore recorded in the corresponding period of 2022-23.

GST collection in Karnataka surged by 20% to Rs 11,693 crore in September as compared with Rs 9,760 crore recorded in the same month last year. Karnataka is the second largest contributor to the country’s GST kitty.

The top contributor Maharashtra also recorded a robust growth. GST revenue in Maharashtra jumped by 17% to Rs 25,137 crore.

Tamil Nadu emerged as the third largest contributor to the country’s GST kitty year-on-year growth of 21%. GST revenue collection in Tamil Nadu surged to Rs 10,481 crore in September 2023 as compared to Rs 8,637 crore recorded in the same month last year.

Gujarat, which was the third largest contributor to the nation’s GST kitty in September 2022, slipped to the fourth position. Revenue collection in Gujarat rose from Rs 9,020 crore in September 2022 to Rs 10,129 crore in September 2023, registering a year-on-year growth of 12%.