The Union Cabinet chaired by Prime Minister Narendra Modi on August 24 approved a ‘Unified Pension Scheme’ (UPS) that seeks to restore key features of the old pension scheme (OPS) like assured payment of 50% of the last-drawn salary, dearness relief in line with inflation trend and family pension.

Under the unified pension scheme, government employees after completing service of minimum 25 years will get an assured pension of 50% of the average basic salary of the last 12 months before retirement. The pension amount will be proportionate for a shorter service period upto a minimum of 10 years. After a service of 10 years a minimum Rs 10,000 per month lifelong pension will be assured.

The new scheme also has the provision of assured family pension. The pensioner’s family will get 60% of the pension received at their time of death.

The scheme will benefit 23 lakh central government employees. The state governments have been given the option to opt for the unified pension scheme. As most states are likely to follow the central government and opt for the new scheme, the number of beneficiaries is likely to go up to 90 lakh.

The new pension scheme will be effective from April 1, 2025. The central government employees will have an option to choose between the new Unified Pension Scheme and the National Pension Scheme (NPS), which was introduced in 2004 by Atal Bihari Vajpayee government after scrapping the old pension scheme.

Before the introduction of the National Pension Scheme (NPS) in 2004, government employees were covered under a pension scheme, which is now referred as OPS. The OPS is fully government-funded, defined benefit system. Under the OPS retirees receive 50% of their last drawn salary as a lifelong pension, without making any contributions during their service.

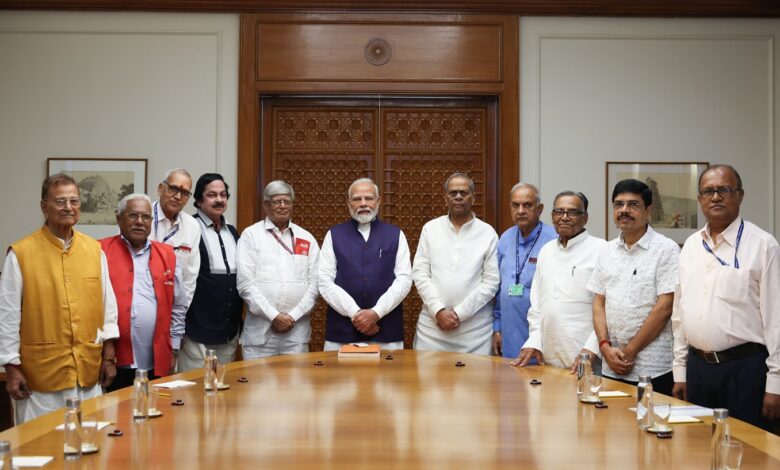

“The Unified Pension Scheme ensures dignity and financial security for government employees, aligning with our commitment to their well-being and a secure future,” Prime Minister Narendra Modi wrote on X.

Briefing media after the cabinet meeting, Union Minister Ashwini Vaishnaw said the new unified pension scheme is based on the recommendation of a high-powered committee headed by T V Somanathan. The committee to review the pension scheme was set up last year under the chairmanship of the then Finance Secretary Somanathan. He was recently elevated to the cabinet secretary position.

“Following extensions consultations with everyone, including the Reserve Bank of India and the World Bank, the committee has recommended a Unified Pension Scheme,” Vaishnaw said.

When asked about the government employees opting for voluntary retirement (VRS), Somanathan said such employees would get pension only after the date of superannuation. This means if an employee takes VRS at the age of 50 after completing 25 years of service, his/her pension will start only after superannuation date, which is normally 60 years.

Under the old pension scheme, which was discontinued in 2004, retired government employees receive 50% of their last-drawn salary as monthly pensions. The amount keeps increasing with the hike in dearness allowance (DA).

Explaining the difference between the OPS and the new UPS, Somanathan said, “the OPS is an unfunded non-contributory scheme. This (the UPS) is a funded contributory scheme.”

The old pension scheme is not contributory. So the entire burden of the retirement benefits falls on the exchequer. In the case of the National Pension Scheme (NPS), there is a corpus of funds. Employees and employers contribute to the corpus.

According to Somanathan, the UPS “remains in the same architecture of a contributory funded scheme” as the NPS.

“The only difference in the changes that are made today is to give an assurance and not leave things to vagaries of market forces. The structure of UPS has the best elements of both (OPS and NPS),” he added.

The broad contours of UPS include the following:

- Employees who have adequate service will get an assured pension of at least 50% of the last 12 months’ average salary as pension.

- Minimum pension of Rs 10,000 per month will be given to those with at least 10 years’ service.

- Family pension to spouse will be given @60% of the pension.

- Dearness relief will be given on the assured pension, minimum pension and family pension.

- In addition, a lumpsum will be provided at the time of retirement.

There will be no increase in the contribution from employees but Central Government will increase its contribution. Those who have already retired under NPS will also be eligible for this benefit. Arrears will be paid to such past retirees after adjusting the withdrawals already made by them. The scheme details and eligibilities are given below.

The employee contribution shall remain un-altered at 10% of (basic pay + DA). The Government contribution will increase from the present 14% to 18.5%. The pension corpus will be divided into two funds:

- An individual pension fund to which the employee contribution (10@% of basic pay and DA) and matching Government contribution will be credited.

- A separate pool corpus with additional Government contribution alone (8.5% of basic and DA of all employees).

The employee can exercise an investment choice for the individual pension corpus alone. The employee can withdraw upto 60% of the individual pension corpus with proportionate reduction in assured pension.

Assured pension will be based on the ‘default mode’ of investment pattern notified by PFRDA and considering full annuitisation of individual pension corpus. In case the benchmark annuity is lower than the assured annuity, the shortfall will be made good. In case the individual employee corpus generates higher than assured annuity (based on investment choice exercised by the employee), the employee will be entitled to such higher annuity. In case however, the annuity generated is lower than the default mode, the top up provided by Government through UPS will be limited to the benchmark annuity.

Full assured pension will be available for a minimum qualifying service of 25 years. For lesser service, starting from at least 10 years, pro rata assured pension will be given.

Employees would have a choice to opt for UPS. An employee could choose to continue with the NPS, if s/he so desires.

The UPS will be given effect from 01.04.2025. The necessary administrative/ legal support framework will be put in place.

The scheme can also be adopted by State Governments. This is expected to benefit over 90 lakh employees (23 lakh Central Government employees, 3 lakh employees of Central Autonomous Bodies and another 56 lakh employees of State Governments and 10 lakh employees of State Autonomous Bodies, if adopted by the State Governments).

While benefiting the employees, it will also safeguard the welfare of the common citizens because the scheme will be fully funded, i.e. Government will fully pay its contribution each year and will not postpone the pension expenditure, thus preventing fiscal hardship to future generations of citizens.